HIGHLIGHT FROM CIM

ROCI: A Framework for Determining

the Value of Competitive Intelligence

|

| |

By David J. Kalinowski

President and COO

Proactive Worldwide, Inc.

and

Gary D. Maag

Chairman and CEO

Proactive Worldwide, Inc.

|

|

The ROI Challenge

At one time or another, all competitive intelligence professionals have been challenged to demonstrate the value of their output. Establishing the value of intelligence continues to be just as much a concern now as it was when the field was in its infancy in the mid1980s. This article looks at what Jack — and other competitive intelligence professionals – can do differently to demonstrate how intelligence benefits the bottom line. A recent online discussion on the SCIP LinkedIn site — as well as hundreds of conversations we have had with intelligence professionals over the past two decades — make it clear that the vast majority of individuals with competitive intelligence (CI) responsibilities either don’t believe that it can be measured, don’t believe it

should be measured, or simply don’t know how to measure it. This is very concerning, because if intelligence professionals are not demonstrating the value they contribute, then the profession will likely never reach its true potential, which is to be an essential component of every company’s success.

In 1996, Jan Herring created what was perhaps the first tangible input on measuring competitive intelligence return on investment (ROI):

Measuring the Effectiveness of Competitive Intelligence: Assessing & Communicating CI’s Value to Your Organization. He emphasized that competitive intelligence “must be measured to be valued by companies.” Herring also challenged others in the intelligence arena to build upon what he developed to help further advance competitive intelligence as a profession. A decade went by, and little additional work was done to move the ROI topic forward. In 2005 we took on the challenge and created a framework for demonstrating the value of intelligence. After introducing the framework at the 2006 Frost & Sullivan (F&S) MindXchange on competitive intelligence, we have presented this topic at F&S or SCIP events in each of the past five years, along with training in customized corporate workshops. Based on the feedback we have received from practitioners, and input from session workshop attendees and others in the intelligence community, we have periodically made adjustments and fine-tuned the framework and now want to share it with a broader audience. Although we developed this framework in a consulting environment, it is also designed to be applicable to leaders of internal competitive intelligence functions and other external consultants who serve CI clients.

This article summarizes our approach, which we named ROCI® (“Rocky”): Return on Competitive Intelligence. It isn’t 100% perfect, but it is practical — and it works. Does it take time and persistence to implement? Absolutely. Can portions of it be further refined? Probably. Will it provide guidance and structure on how to best demonstrate the intelligence team’s ROI? Definitely! Here are the core elements of the ROCI® framework:

- Define ROI in a CI context.

- Measure benefits.

- Assess the impact of CI.

- Deliver high-impact reports that demonstrate value.

-

Create a CI culture that supports value.

(Click image to enlarge)

Importance of Demonstrating Value

Ultimately competitive intelligence is a support function. It may be viewed strictly as overhead, making

it an easy target for budget cuts during tough economic times. To convince management to spend resources and build support, intelligence professionals must demonstrate its contribution to the company’s success. What is the harm of not measuring ROI on CI?

- Clients (internal and external) question the function’s validity.

- CI is not viewed as essential.

- CI’s contribution to strategic and tactical successes is not recognized or rewarded.

- Leadership can’t assess if the company is allocating resources properly.

- CI group loses budget.

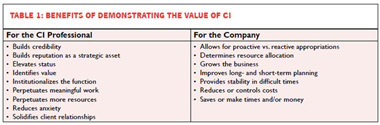

Some of the benefits of demonstrating the value of competitive intelligence are summarized in Table 1.

Define ROI in a Competitive Intelligence Context

Many different formulas can be applied to determine ROI. None of them is the perfect option, as Kenneth H. Silber, PhD points out in his April 3, 2002 white paper titled, Calculating Return On Investment, Version 4.0. Silber states that each formula tends to have its own set of assumptions, and that the ROI model selected depends on which one the company or client will value and believe (Silber 2002 p1).

When calculating ROI, Silber observed that some people provide what management is used to seeing — a ratio — by defining ROI as “Benefits Divided by Costs.” This is the classic definition of ROI measured as earnings divided by the investment, whatever the subject area. To calculate the return on investment in competitive intelligence, the earnings are the program’s net benefits (monetary benefits less the costs). The investment is the actual program cost.

For our purposes, let’s keep it simple and use the formula:

Benefits

Costs

This benefits-divided-by-costs formula will provide an ROI ratio. To create an ROI percentage, multiply the result of the equation by 100. For example, if the benefits are $1 million and the costs are $200,000, then the ratio is 5:1, or an ROI of 500%. Of these two elements, the costs of competitive intelligence are relatively easy to calculate (personnel time, salary/labor cost, travel, equipment, databases, materials, outside professional research fees, and perhaps an appropriate proportion of fixed costs). However, the benefits are the more important element to focus on. The difficulty lies in developing the actual monetary benefits in a credible way. Determining the benefits — the value of the intelligence outputs — is the most controversial part of the ROI process.

Determining benefits is not an exercise in precision. In fact, we argue that it’s more about perspective than precision. However, we also believe that it is quite possible to develop a more precise perspective.Determine Performance Metrics

Every structure, model or framework needs a solid foundation from which to work. In this case, knowing what to measure is the foundation of our framework. In 1996, Jan Herring identified five key areas that can be measured to determine the value of competitive intelligence. These categories, which comprise a portion of our framework, are still used as guidelines today by numerous CI practitioners across multiple industries for developing perspectives on the benefits of intelligence:

- Time savings: Savings for both professional and support personnel.

- Cost savings: Elimination or reduction in expenses.

- Cost avoidance: Elimination of planned expenses.

- Revenue increase: Increase in the number of sales or size of sales.

- Value added: Benefits not easily related to specific dollar values, such as more effective strategies or better/new products and services (Herring 1996)

We have identified other – but by no means all — items to measure. They include:

- Client retention

- Customer satisfaction

- Employee retention

- Market share

Productivity improvements

- Profits

- Quality

- Reduced reaction time

- Surprise avoidance

Every reader of this article can identify their own top key performance metrics to measure, creating numerous additions to this list. This illustrates the need for any ROI model or framework to be flexible.

Read the full article published in Competitive Intelligence Magazine

January/March 2012, Volume No. 15 Issue No. 1.

About the Authors

Proactive Worldwide, Inc. co-founder David Kalinowski oversees all operations and administrative responsibilities at Proactive. He also implements actions to achieve short-term goals related to the firm’s long-term strategy. He has directed research and consulting assignments for hundreds of domestic and international corporations and is known for his skills in helping clients transcend their competitive challenges. He also assists executive boards as a trusted advisor on counter-intelligence matters. David frequently shares his knowledge through industry presentations and has been honored with SCIP’s Catalyst Award.

Proactive Worldwide, Inc. co-founder Gary Maag has over 20 years of experience in research and consulting. He oversees sales and marketing activities and leads the firm’s long-term strategic initiatives. A passionate industry educator, some of the most popular topics in his workshops include demonstrating return on investment and the importance of evidence-based intelligence in establishing a global mindset for business development in emerging markets. Gary has received SCIP’s Catalyst Award and Northern Illinois University’s Distinguished Marketing Alumnus Award.

|

|

|

|

|

|

|

|

|

|